So if the retail consumer is staying strong and spending like a drunken sailor (my apologies to drunken sailors–was my dads term and he was a sailor in WWII) is there a need to cut interest rates? I was leaning toward September in my mind, but the sales report this morning doesn’t feed into that thought very well. Certainly we have plenty of data to come in before the September meeting–and we have a FOMC meeting starting in 2 weeks for July so we will have more ‘thoughts’ from them (the Fed) soon.

The 10 year treasury yield was trading down at 4.17% before the release of retail sales but popped back up to 4.22% after the release, but has now drifted back down to 4.19%.

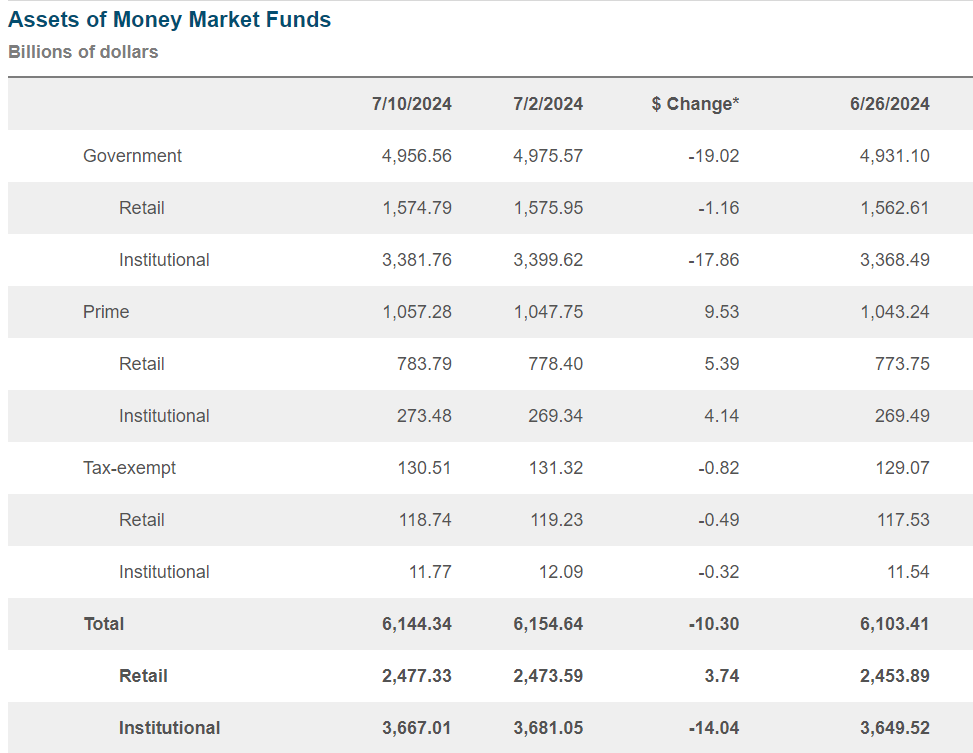

Equities are partying like it is 1999–I checked the amount of money in money market funds in the U.S. just a bit ago and the amount of ‘dry powder’ available to power stocks higher is incredible. $6.11 trillion is one hell of a lot of dry powder. IF the FOMC starts cutting rates we will see one heck of a melt UP in stocks. I think it will take rates to back off under 4% on the 10 year to set it off.

I will be buying one of the baby bonds from Runway Growth Finance (RWAY) today–this is a decent business development company. The baby bonds have coupons of 7.50% and 8.00%. Looks to me like the 8% issue (RWAYZ) is the one (although it is almost a coin toss). They just published a portfolio update late last week.

When rates are actually cut I’ll react accordingly. Until then I donlt pa=y much attention to futurists predictions.. Or listen and play the opposite side of the over-reaction. … I suppose my bias is showing.

For what its worth I own approx. 50+ different Corp. Bonds and they have all already been “repriced” in anticipation of lower rates from Powell on the horizon. Try to find a “Good Deal” in the Corp. Bond market—virtually impossible at present time.

Chuck, I have been noticing that for almost 2 months, especially with BBB- bonds. Now all I see offered is REIT Corp bonds. Feel like Fidelity is trying to have a rummage sale and sell all the dogs with fleas.