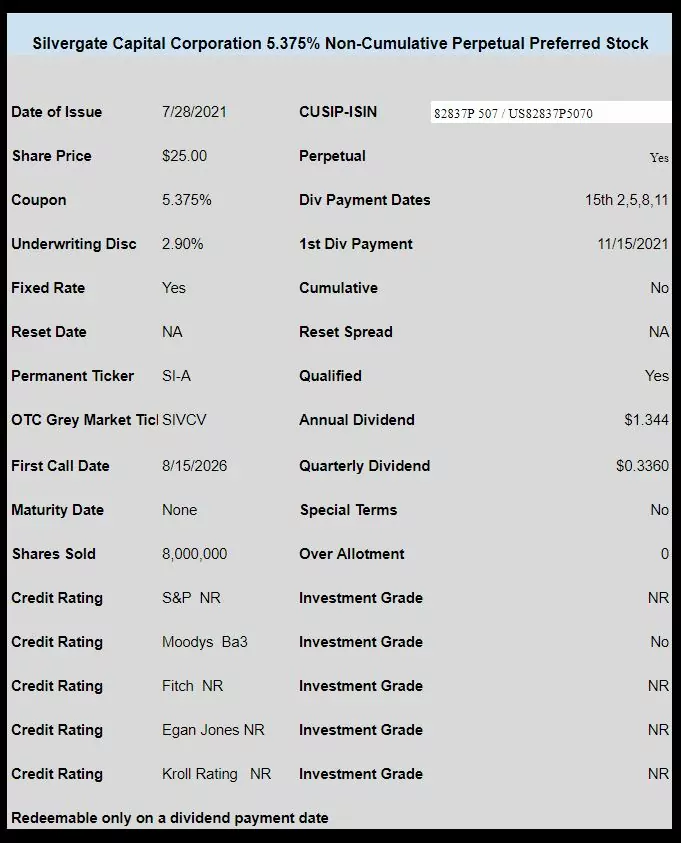

Silvergate Capital (SI) has priced their previously announced new issue of preferred stock.

The company priced 8 million $25/share preferred stock with a coupon of 5.375%.

The issue is non-cumulative and qualified. The issue carries a junk rating from Moody’s of Ba3.

The issue trades immediately under OTC grey market ticker SIVCV (watch for ticker changes by the OTC).

The pricing term sheet is here.

SI-A is taking a dump today due to ?Silvergate Capital raises $480M through stock offering? or maybe the recent crypto drop?

Either way it is a 5.5%. with a reasonable risk rating.

I bought some for a flip. SI already fell because of the secondary. If that’s the reason SI-A is late to the party. Preferreds not affected as much by dilution of the common. The pattern of sudden drop on large volume looks like one big seller.

BW-A also down 50 cents lately while BW went up. Preparing for the new issue?

fc:

I would say the fall is because you are buying a non-cumulative preferred with a somewhat paltry yield (5.5%) in a very high-risk sector (crypto).

Common equity raises should be very good news for preferred stock holders, as it gives the company more funds to pay costs, dividends, and interest. But they are offering stock at $145/share that once traded for $240+. That should be a warning sign.

I’m hoping to one day have the chance to buy SI+A below $20.

I assume we all know banks are all non-cum now days. It is a given. As for a paltry yield compared to what that is Ba3 area? Now I know IG ratings have to be taken with a grain of salt but that is what we have to work with besides their actual financial statements and SI makes money in what appears to be a growing area as it stands today.

I agree common equity raise is a positive for pref shareholders. It just means more money to pay our divs. They pretty much did it because of the euphoric run up of their common shares. I don’t blame them.

As for the stock price itself it is typical of the crypto realm. ETFs are being created which has SI. People want exposure in some fashion. SI sure sits in a nice area where it is not rampant speculation like mining companies or other companies who just outright buy crypto. They want to be a middle man which wall st well understands.

Interest rates risks are always a concern. More so for <= 5% perpetuals then something that pays 5.5% at this purchase price. It should hold up somewhat better then lower yielding preferred at first unless you think rates are going to go up fast.

In the end this company makes money. Actual profit. I am not sure where any preferred will be at if you think you will pay 20 and capture a 6.7% yield on a Ba3. The rest will be in the trash as well unless you think SI will become much more speculative due to ?losing money soon?

Also the stock price is above 170 and the offering is at 145 which closes tomorrow. How does one explain that? Wouldn't we expect the price to be below 145 as I type this??? This company could be a take over candidate if they keep on chugging along as a different bank would just integrate their first mover advantage.

Hate it or love it… crypto is here. I tend to hate it as a person who was in it very early and became disillusioned it was never going to be a currency anytime soon. But I have no problem taking a more conservative position to profit from the zaniness.

fc:

My view is that dramatically higher interest rates (what were once considered “normal”) is going to massively pop the crypto bubble, and many other asset bubbles. You might be now seeing the early stages of it.

I could see depositors fleeing SI in droves. I would lay 2-to-1 odds that SI will be the first “bank” to “skip out” on a preferred payment that they don’t have to pay anyway.

But hoping I am wrong and you make money on it!

Well if we have dramatically higher rates I will probably have bigger worries then my SI-A shares.

But remember that SI depositors did not place their crypto and money at SI for yield. They want access to that SEN platform. Their customers are exchanges, wall st, etc.. not retail. They also do not hold crypto on their balance sheet. I feel they are in a sweet spot even if crypto goes up or down. They just take their slice of the action in typical bank style.

SIVCV not getting much love. Picked up a bit at 24.50. It will be interesting to see where it finds a foothold.

Same here, small position at $24.60. So far this has seen ample supply: yesterday it traded over 2 mill shrs, today volume is 745K. As long as supply over runs demand this will have a hard time lifting off. When a duck quacks someone is there to feed it.

I told myself I was not going to buy but at 24.38 I will take a couple hundred to put in the higher risk bucket to juice divs a tiny bit. They make money and I will just have to keep an eye on it.

You got a little typo capiral in the ‘new issues sheet’

Jos–impossible–just kidding.

I am going to pass on this one. Guess I am a little old fashioned as this one doesn’t meet any of my criteria that the product isn’t produced from something grown or dug out of the ground, an intellectual product like software, or debt for companies to expand in a business I understand…. think the last one fits this one the best!

Picked up a bunch at $24.90

It will be interesting to see how it does. BPYPM is trading lower today so these new issues aren’t exactly rocketing out of the gate like they have been for a while.

I bought a minuscule amount of SIVCV and TD Ameritrade charged me a Foreign Security Fee. Has anyone else been charged this fee?

Wasn’t charged anything at Fidelity.

But to make up for it Fidelity has been flaky in getting new issues to show up properly in people’s accounts lately.

They charge 6.95 for Pink (BB) stocks which is where new preferreds trade before going OTC.

The V at the end of the ticker symbol designates “when issued”. After issuance, the V typically changes to P. Subsequently, the permanent ticker symbol is adopted. Is that correct?

Probably a mistake, but I declined to flip this based on risk/reward considerations.

That is correct.