Disclosure–I own this security and am ‘talking my book’ here. Not a recommendation as each investor determines their own risk/reward demands.

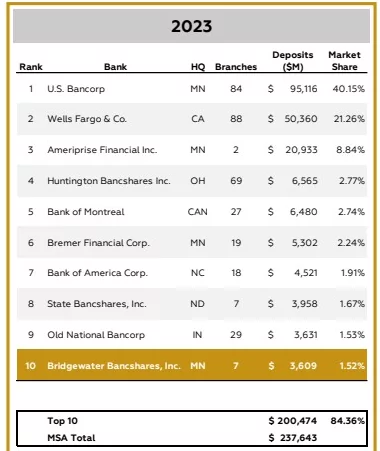

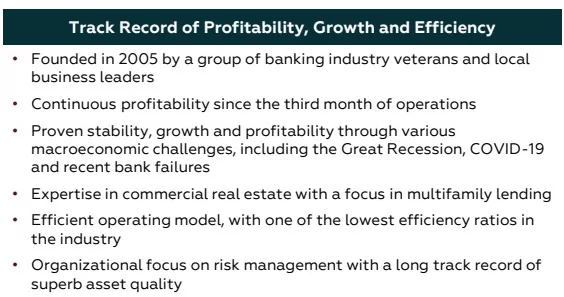

I am trying to figure out what I am missing with Bridgewater Bancorp (BWB), the smallish Minnesota bank that I have mentioned many times. Is it simply because I live in Minnesota? Certainly I have a bias in that regard–sometimes it seems like you ‘know’ a company better just because you drive by their banks from time to time. But in the banking scene in Minnesota this $4 billion banking company BWB is simply a pimple on the butt of an elephant.

Is it because while many banking companys have had their preferreds jump nicely in the last couple weeks as interest rates have dropped little old BWB has gotten no bump at all and thus yields 9.55% at Fridays close? Why is my little banker preferred being punished?

Is it because someone ‘knows something’ I don’t know? Not very likely given the banker just published their 3rd quarter investor presentation 4 days ago—it is here.

Or is it simply because as Gridbird has correctly said many times ‘names matter’. Witness the Gabelli Funds CEF preferreds–really nothing special about these funds but the preferreds garner great respect—but the name-Mario Gabelli – the friendly gent we have wached on TV since ‘Wall Street Week” with Louis Rukeyser started in 1970 garners respect. Bridgewater Bancorporation – who the hell is that?

Well to get by the bolony stuff –what are their numbers? Is there big time trouble ahead? Well let’s check the data out!

A thumbnail sketch of BWB–

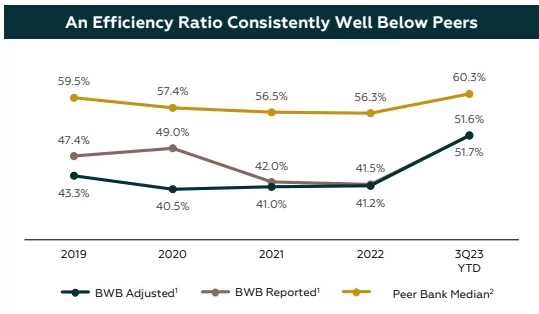

I have been quite amazed at the efficiency ratio of Bridgewater. Only in the last 6 months have I started watching this as a sign of a well run bank. BWB has always been low – although with the net interest margin getting squeezed in the last 18 months their efficiency ratio jumped – but still very low compared to competitors. I suspect they will get their net interest rate margin up during the next 6 months and their ratio will fall. The efficiency ratio is how much non interest expense is required to generate revenue.

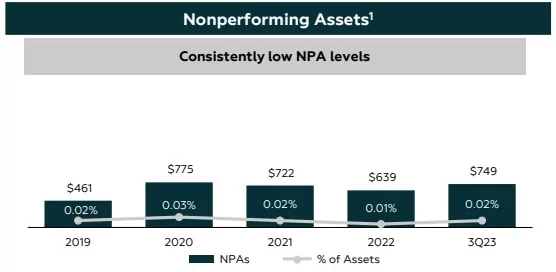

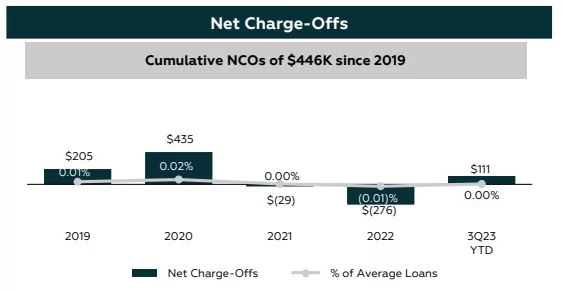

Then I look at the non performing assets and net charge offs – to say they are low would be an understatement. Less than 1/2 million charge offs since 2019–essentially zero.

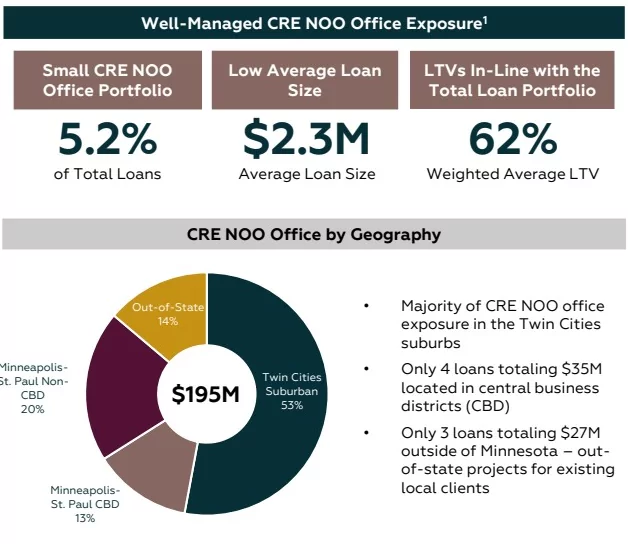

So does BWB make office loans all over the U.S.? No–only 14% of the office loans are out of state with the balance mainly in the Twin Cities–and only 13% of those are in the central business districts (downtown)-the balance are suburban. The average loan size is small with excellent loan-to-value (although one should be skeptical of LTV numbers of all lenders–values are falling and what was a 62% LTV might be 80% now).

Or maybe it is articles like this one that ran in the local newspaper a few days ago that has spooked investors (not sure everyone can access–I have a subscription). Although with a 2.98% of office loans in default across the Twin Cities right now the risk seems somewhat muted. Will defaults rise? I think they may double or even triple in the next year depending on where interest rates go. But as shown above the average non owner occupied office loan at BWB is $2.3 million – these are more like loans on small properties – realtors, bankers, dentists and the like – not office towers in the downtown area, which seem to be continually in trouble. I would expect BWB to experience some increases–but not super serious increases—when you are near zilch there is only one up to go.

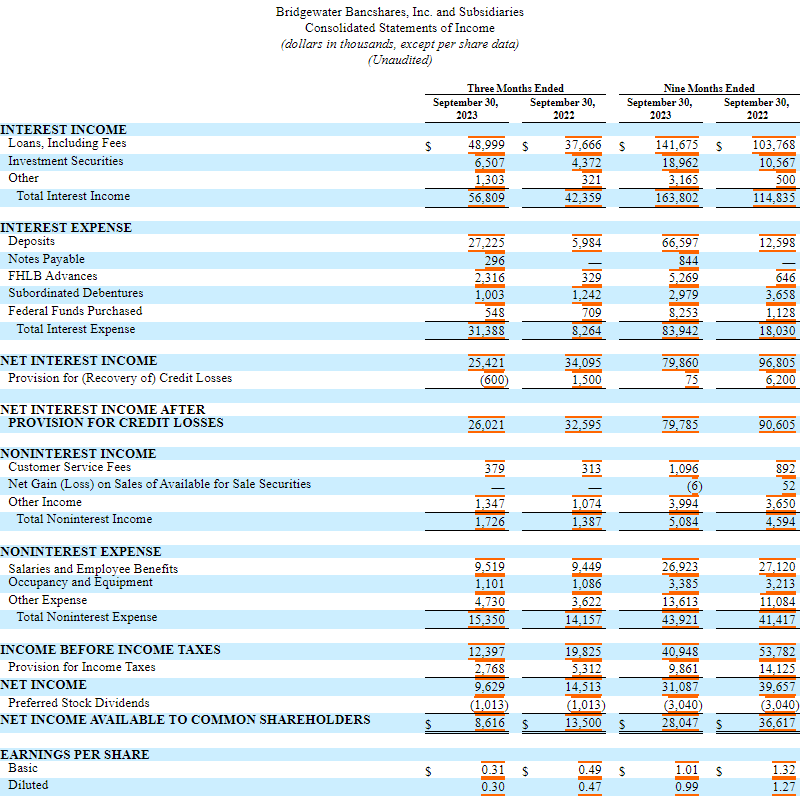

Yes earnings at BWB have been down—not unexpected as the costs of funds rose sharply–as it did for every lender. As you can see below the cost of funds rose 5X year over year. While interest income rose substantially it certainly didn’t keep pace with the cost of funds. This will change for BWB and all banks as the costs of funds falls and interest income rises. So assuming this is already occurring as rates have fallen I would expect improved net interest margins—at least for the next few quarters (then who knows for sure as the interest rates for the future are not really predictable). Below are the financials for the latest quarter and 9 months–softer–yes–terrible–no.

So with a careful review I added to my position on Friday and added more this morning (at 15.52) I am at now at 50% of a full position. We’ll see what happens and determine further moves.

Note that I am ‘talking my book’–this is not a recommendation, but at 9.55% current yield the risk/reward seems good – I would think a 10-20% capital gain is attainable in the next 3 months or so (plus dividends).

Thanks Tim for the headsup on BWBBP. It’s up to 17.80 today. I didn’t plan to hold long term so I’m out now but it was a hard decision since at that price the div is still over 8%.

Oh boy. I read through all of Tim’s post, did some more looking on my own, and decided to purchase a small position using a limit order since it was having a positive day at the time. Well, the same story I have had before. Since then it has done nothing but go up. Good for those folks who got in a little earlier, but bad for me!

I was trying to review a couple dozen mid cap banks today. The research has changed due to basel. Lets just say it’s complicated. Common Equity tier 1 ratio (CERT1) seemed much higher than my back of envelope calculations!

Provisions for loan loss are one area I’ve always reviewed. At least the reports I could access showed them all stacked together. Not that you could definitively say a bank was better/worse than others based on 1 number it was interesting to see areas of concern. And wouldn’t’t you know many of the high flier pfds I’ve built positions in…….have areas of danger!!!

Also interesting was a listing of their tradeable assets listed by sectors. You could see CMBS RMBS and treasuries etc broken out per institution! What that seems to indicate to me is that Basel 1 2, 3 have forced all the banks to own basically the same assets. Instead of mostly their own loan books…now we have to be concerned those top ‘rated’ bonds they loaded up on to please regulators may contribute to their issues.

Couldn’t see anything on BWB

Well, BWBBP is up today (11/21) as I type this by 2.21%, on 2.5x the usual volume. I’m giving this website total credit for this!

I probably will still sell BWBBP in December for tax-loss purposes, but congratulations to those who have had better timing on this issue.

Could you do a breakdown on FGBIP? That’s another dog in my portfolio that could use a boost.

Just kidding! Appreciate the report on BWB.

This credit report sheds some light on the market’s outlook for BWB. I have no dog in this hunt.

https://www.kbra.com/publications/fzskFncz/kbra-affirms-ratings-for-bridgewater-bancshares-inc

bot a slug of BWBBP at 15.50 Friday 11/17 at 15.50; 9.48% yield to reinvest elsewhere; No div on the common to worry about so decent pfd div protection; strong insider ownership at 20% aligned w us; 4 insider buys since the ‘banking crisis’ in March ’23..http://www.openinsider.com/search?q=bwb

Adding pfd exposure in the last few mos personally including banks, if its good enuf for Tim good enuf for Bea; appreciate the idea and detailed review and attachments.

Glad to see you post again, “Snipper Bea”. Dont be so shy. Tim doesnt charge too much to post around here, and besides you can afford it anyways!

No my fee to hang around and post – good to see you Bea. Let’s hope for a continued bounce in BWBBP.

I’ll raise a glass of Glacier Water to you Tim…these many years..everyone wants to be-or thinks they are- ‘Yield Hunters’ these days, you are the OG.

Bea–ah-yes those days were good. Things seemed to be much easier ‘back then’ or maybe it is just turning 70 this months means I am over the hill.

Tim, I was looking for a list today of Exchange traded debt ( baby bonds) came across a website called dividend investors. Had your smiling face and a old spread sheet of yours from 2019

Oh yes, Glacier Water was the good old days. I am still using the dispensers and thought it would be a great investment idea at the time. I googled it and found your write up. Been following you ever since.

Looking at BWBPP as a trade, not an investment. Here I would look at technical indicators such as RSI and MACD to get an idea of how it may trade short term in the future. Both indicators are fairly flat, but I see a bit of momentum that could put some tailwind behind BWBPP. My price target would be the 200 day moving average in the low $18s where it would have to retest and prove itself. Technicals showing near zero chance this gets above $20 in the current environment.

I see enough progress I’ll jump in with a small position.

Fundies show me it’s not going bankrupt which is great and let’s me play the game, but charts can then show the best probabilities of price movement.

legend.vs–I was thinking a bounce into the 17-18 area in 30 days simply as folks look for a higher yield to trade into.

At my age, I’m more interested in income rather than capital appreciation. Having been burned a few times in the past by unnecessarily reaching for yield, I now invest primarily in lower tier investment grade securities of large firms. TBTF banks are an example. An unrated example are the CHS issues because I consider them high quality.

However, I occasionally buy smaller, unrated companies that have a high yield. I view BWBBP as a fairly safe investment offering a high yield. I just bought it Friday at $15.50 for a 9.48% yield. Eventually, when rates come down, it could have significant price appreciation in a ‘rising tide lifts all boats’ situation. If not, I am very happy with the yield and I don’t feel it’s in danger of going belly-up.

Sounds like FGB/FGBIP, though they’re having much greater deposit cost problems, it seems.

Tim, my concern is did BWB borrow from the fed window during the panic last March and how much? My understanding is that is a term loan for 1yr that has to be paid back. I know there has been talk about the Fed coming up with a new program to extend the loan.

Have they indicated how they plan to pay the money back if they did?

Charles that was one thing I researched. The answer is a definite nyet. Look at page 27. They also have no hold to maturity securities and past due of 30-89 days has been under 0.05% for 23 quarters. Still, its a bank, and its not called “utilityruptcy” for a reason.

https://s25.q4cdn.com/647121665/files/doc_financials/2023/q3/3q23-investor-presentation-final.pdf

Thanks for the quick response Grid. I’ll have to wait to get home to check it out. My screen on the phone is too small !

Tim; ive owned this one for a long time (since the banking crisis) and just added to my position last week ; lowered my cost basis to 16.47 ;i’m sticking with it .

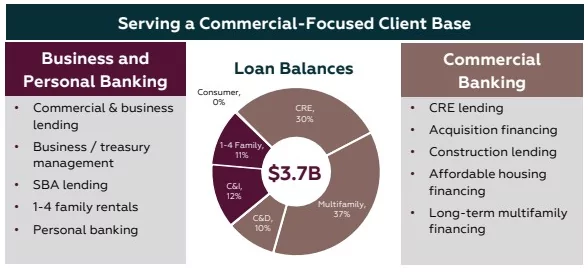

I was looking at this when you mentioned it last week. I think the discount here is a combination of two things:

1. BWB is very concentrated in CRE and Multifamily housing. CRE scares a lot of people off to begin with, but there are rumors of cracks starting to show in multifamily: landlords are finding it harder to raise rents, rolling debt is more difficult and expensive, etc.

2. BWB grew their assets by over 100% in the last four years. The market has taken a dim view of this kind of thing, because it implies origination wasn’t stringent, and it helped strike down First Republic and Silicon Valley (even though their ultimate problems were being horribly positioned for rising interest rates). You can also see it depress the prices on the preferred of MBIN and CUBI, two other fast-growers.

I’m not exactly sure how valid these two concerns are. I imagine you’ll probably be fine here. But for my money, in the 9%+ pile, I prefer PACWP, which has ALREADY been through the wringer, will be merging with a stronger partner, and is getting a $400MM infusion from the sale of common stock in two weeks.

Just my 2c, good luck to all.

PACWP would have been a wonderful buy back in May when it was trading for under $9. My crystal ball wasn’t working and I missed it.

I put 500 shares in my high risk bucket Friday. Not buying more. Interpreting leverage to loan quality of banks is beyond the SF Fed Reserve and mine also. But the common stock is bouncing up over 13% past month. So that was largely my impetus to play ball here in the high yield sand box. It shouldnt matter, and largely doesnt, but mentally I do like a company with preferreds to pay common divis though. That aint happening here as one notices.

I purchased a small position (100 shares) just so I could monitor and collect the divvy

Yazzer,

I did the same. I like buying small positions in what appears to be on sale preferred to watch it more closely. So I bought 10 shares a while back and after reading the latest report I bought 90 more. I will probably sit on it and see how it performs until the next quarterly.

This is not exactly a name I need 25K invested in but a smaller amount is OK for me personally. It “seems” like a reasonable way to juice yield by not going all in and selectively picking after some research. I do not mind owning a lot of positions.

Let’s not forget that BWBBP is a very low volume stock. The simplest explanation is that someone has been closing a position.

I also note that PACWP has not been trading much better, despite the BANC merger tailwind. Maybe 9.3% is the new normal.

Tim, Through my own lens, 2 cents worth roughly 1.5 cents…

Gabelli: Not just a name, most “Gs” are Moody’s rated between A1 – A3

BWB: Appears unrated

Also, appears BWB has declining EPS projected for 2022 to 2023 and 2023 to 2024. Just me, I’d prefer seeing BWB turn that corner.

On the other hand, highly supportive of your hold is that the risk spreads are adequately compensatory on this one. That’s a big plus.

Hope you hit a home run.

alpha–not really comparing Gabelli to BWB–it was just a ‘for instance’ about names mattering.

A very big portion of their book is CRE. Have they taken enough reserves? Also very big in multi family which is getting overbuilt. You are probably right in the long run but right now anything real estate related = Bad. I would just focus on their liquidity to get through a bad real estate cycle. By the way, I know nothing about Bridgewater!! Best of luck.

Scott–maybe it is as simple as ‘real estate’ that is the problem.

Tim, in the end its largely is the real estate worth more than the loan. And hopefully they are. During covid crisis, CEO NYCB was asked in a conference call if the owners could pay their loan obligations. He basically said who cares, as they would foreclose, sell them again, and make more money off the properties as they were worth more than the loan amounts.

Grid–I see the supposed ‘loan to values’ as BS numbers – they are all overstated in my opinion. But yes you are correct in general the value of the collateral is key.

That comment made sense during Covid and still so in NYC (as no new inventory is practical in that area). However most of the country now has new inventory and many financed IO assuming lower rates and appreciation in the future. Some banks will roll over the debt; some investors will have a capital call and some will let the bank have it. One has to dig into the local numbers where the loans exist.

Thus why I said… hopefully the value of the property is more than what the loan values are….As previously mentioned I dont know anything about how the numbers ultimately work out with a banks financials. Bankers themselves dont always know either apparently. Thus why its relegated to the good ol small high yield bucket.

Ah, guys…………..

Banks

“The value of the real estate”………….

Right now, nobody knows.

There are no sales.

No one is willing to buy at anything other than graveyard prices.

Owners/banks aren’t willing to sell at those prices because the sale will force them to mark down what they still own.

“We can foreclose.”

It’s a joke.

I know, I used to finance real estate.

You can foreclose on a house or a car – there is always a market for them.

But an under-performing piece of commercial real estate?

The worst is a hotel.

Never foreclose on those.

Westie, Just asking your opinion, But the great Covid reset lets call it has flipped CRE on its ear. Notice looking around how much CRE has been in trouble in large city centers and these properties have loans in the tens to hundreds of millions of dollars in trouble? I think we are seeing CRE holding up the best in suburban locations and the loans are a lot smaller. If a bank spreads its money over a hundred commercial loans and 3 or 4 go south it’s not as big a problem as having the same amount of money in 10 properties in a downtown area and one or two go bad. BWB has over 1/2 of it’s CRE loans in suburban areas.

Hi Charles

I have no issue with your thinking.

My view is: why bother with such tricky analysis when there are so many opportunities to earn a “safe” 7% elsewhere with a pretty good chance to also get capital appreciation.

Banks are permitted/encouraged to obscure their CRE risks by regulators in the hope that things will get better over time. My point above was that foreclosure is a last resort strategy employed only when then borrower is clearly insolvent and the secured property is believed will lose further value in its hands.

More detail than you want to know about banks’ accounting…..

Banks’ real estate loans are housed in three categories:

Performing

Non-Performing

Real Estate Owned.

Balance sheet treatment of the various categories is directionally similar to what banks do regarding their respective bond holdings: Held to Maturity and Held For Sale

Performing loans/bonds held to maturity are valued based on their original assumptions and do not have to be marked-to-market no matter how adversely conditions have changed.

Non-performing CRE loans have to have defensible reserves against loss.

Bonds held for sale and real-estate owned have to be valued based on actual market comps.

Banks can smooth their accounting by moving bonds from one category to the other and, for CRE, by extending/modifying the terms of the loan to keep it Performing. For example, if a CRE loan has a minimum % leased covenant that it no longer meets, that covenant can be waived or modified to keep it Performing.

In sum, backed by the FDIC and the federal regulators desire to avoid failure, banks’ accounting can obscure actual risk.

DYODD is hard to do in this environment. So, while I don’t disagree that suburban is better than urban, I am just asking “why take the risk?”

Never lose sight of the fact that banks’ normal loan gross profit margins are @ 4-5% and their admin costs @2-3%. Net 1-2%. If one loan in 50 goes 100% bad, the bank’s loan portfolio is break-even.

Banks make their money on free deposits and fees.