Markets are likely to trade in a wider than normal range this week-stocks and interest rates.

Regardless of what fundamental data we see this week, the middle east situation will likely dominate the news and thus affect the markets. Historically these types of events have ‘blown over’ in a few days (or weeks), but I get the feeling this one may be with us for longer. When Iran says they will retaliate we simply don’t know if that will happen this week, next month or next year.

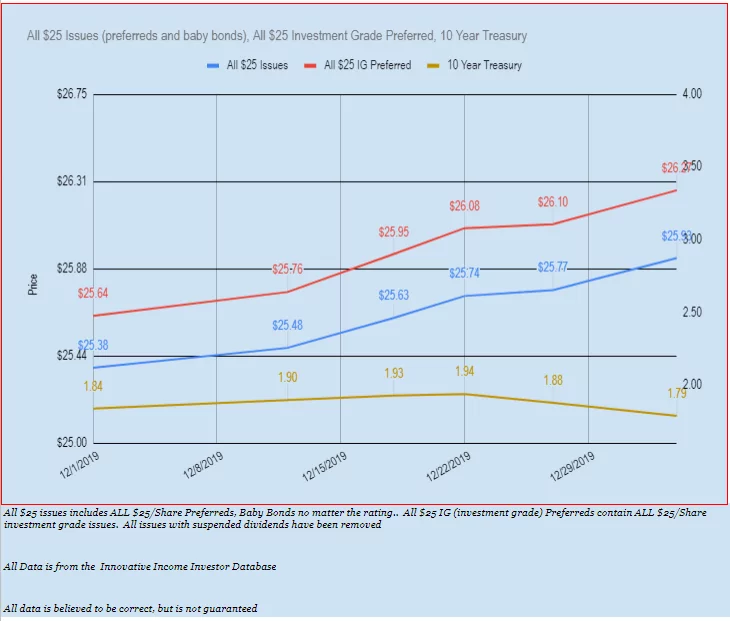

The S&P500 traded in a range of 3212 to 3258 before closing at 3235 which is just a small loss of last week. The 10 year treasury traded in a wider range of 1.78% to 1.94% before closing at 1.79% on a rush to safety.

The Fed Balance Sheet rose by just a small amount on the week, adding $8 billion worth of assets.

Last week we again had no new preferreds or baby bonds offered. After 2 weeks without issuance we will likely see a restart to normal issuance this week.

Pricing on preferreds and baby bonds continued strongly higher last week as you can see in the chart below.