Last week the S&P500 was up by almost 4%. The markets are waiting and betting on a stimulus package from congress and as has been the case all year (or actually a few years) massive liquidity simply keeps moving markets higher. This likely won’t end well, but whether the reckoning comes next week, next year or in 5 years no one knows.

The 1 year treasury closed around .78% on Friday after knocking on the door of .80% all week. This was an increase of about 8 basis points from the close the previous Friday. I suspect if we do get a stimulus package soon we will see an interest rate pop that will put us up in the 1% area (or maybe I am still in my dreams from last night).

The Fed balance sheet grew by $18 billion. While this is a sizable increase the balance sheet fell by $37 billion the week before. It is surprising that the balance sheet isn’t growing faster–the treasury auctions have been sizable recently so all in all liquidity is still sloshing around and huge issuance of debt is still being soaked up–maybe my rant last week was premature? We’ll see how these markets perform when the next $2 billion worth of stimulus hits.

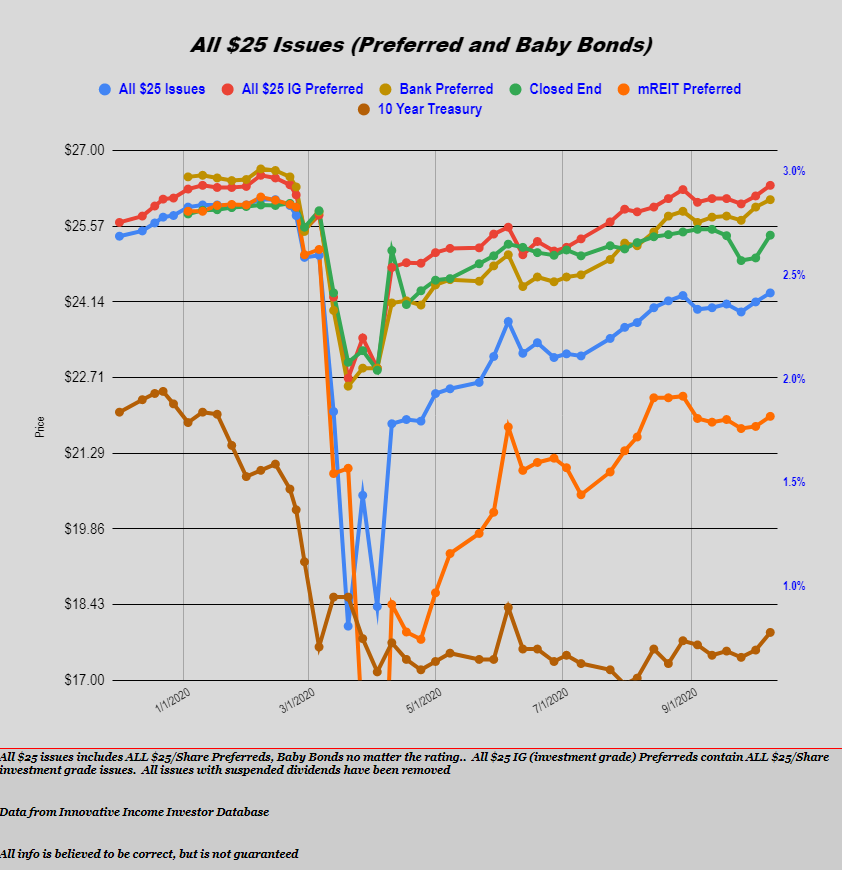

Just like common stocks last week income issues took the opportunity to move to the highest levels since early March.

The average $25/share baby bond and preferred stock moved higher by 17 cents. CEF preferred moved higher by 43 cents, utility issues by 18 cents, banks by 14 cents and investment grade issues by 20 cents. Obvious the move higher in interest rates had little affect on price movements–as expected. Seasoned holders of income issues know that ‘speed kills’–slow movement in rates will have little affect on pricing.

It was a super quiet week in the new issue marketplace. We had only 1 new issue announced and priced.

Only Brookfield Finance (a part of Brookfield Management (BAM)) announced a new baby bond with a 4.625% coupon. You can see the details here.