While we often talk about ‘illiquids’ as many of the $50 and $100 preferreds it has become more and more apparent that the term ‘illiquid’ can be used much more broadly–to many of the $25 issues.

Today I have been trying to double up my position in the Priority Income Fund 6.00% term preferred (PRIF-H). This issue started the day at $24.04 and has a mandatory redemption in December, 2026—so getting me to 8% (+/-). I have changed my good-til-canceled order once and I am leery of chasing the price which is now at $24.15. I was able to get a partial fill at $24.15—so now my order sits. Total volume on the day is 400 shares–I would call that pretty illiquid.

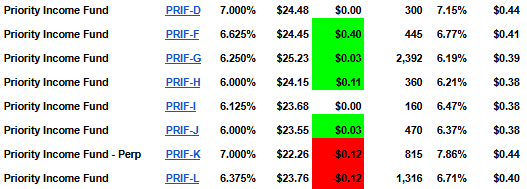

PRIF in total is a pretty illiquid group right now–folks want a decent yield and the level of certainty which comes with the mandatory redemption. Below are the PRIF issue part way through the trading day.

NICE prif-h trading at 25.30 up about 5%. Nice trade so far Tim.

Ha, those PRIF-*’s are EASY to trade! I took a snapshot to look at the bid/ask spreads for $25 face preferreds/babys/terms. Understand that these numbers change every microsecond, but only one PRIF made it to the top 20 at that instant. Obviuosly this was during regular trading hours. During early and late trading, the spreads often widen out dramatically. Common to see $15 to $18 spreads in the pre-market and ~ $6 in the after market.

Sorted by highest bid/ask spread

MDRRP,4.99

LUXHP,1.26

ECF-A,1.02

EFC-C,0.84

ACP -A,0.82

BHR-D,0.8

TFINP,0.8

GEGGL,0.79

FTAIM,0.7

MBINN,0.7

IVR PRC,0.69

PRIF-D,0.66

SOHOO,0.65

BPOPM,0.64

DBRG-H,0.6

REGCO,0.59

MDV-A,0.58

FRMEP,0.55

SOHON,0.54

GGT-G,0.54

Hey Tex, please stay quiet, these are some of my best prefs to trade!

I’ve traded various prif over the last several years and have always found them very illiquid. It’s one that I set a GTC for a price I want and let it sit. They tend to fill if I wait but there’s rarely an ask I really want to pay.

Maine, Irish back in REGCO this past week. Little over 1-1/2 months to the next dividend. Added cushion, the common just raised the dividend. Outside chance next year it gets called if rates go down. Doesn’t meet Tim’s baseline of 7% unless of course I collect the dividend.

I like the defensive setup Bank NY Mellon FTF 4.70 perpetual floats 5yr tsy +435 9.20.25 if not called. Investment grade. Can be had slight discount par. Cusip 064058AH3

DYOD

Sometimes I feel if you have a good idea and confident in your pick just buying it for several cents more immediately can be a good way to go. Too many times in the past I have failed to follow my own advice and tried to save a few cents I will not really care about down the road. Thus missing the opportunity or end up paying even more.

You’re right fc–I mostly have that attitude and may change it to finish off the position before the day is out–more than once I have let something go over a nickel and that probably makes little sense.