Yesterday I wrote a bit on the closed end funds that invest primarily in CLO’s (collateralized loan obligations) and the question of asset coverage ratios has come up.

I do a quick and dirty asset coverage ratio on this page for the CEF’s. Some of the asset coverages shown on this page are directly from the companies—others are my calculations based on an occasional glance at the most recent company data and like all these things if 10 of us calculated the ratio we would have 10 answer. My intention is to be close–not necessarily 100% correct.

So how does one get the asset coverage ratio? Well in the case of most of the closed end funds that invest in Level 1 securities (stocks and quoted bonds) we can simply look at a monthly publication from the fund company. Gabelli which has many funds and who also has the Ellsworth Growth and Income Fund and the Bancroft Fund makes it very easy for us–they publish the coverages each month. You can see the page here. I have this page linked on the ‘Education’ page here.

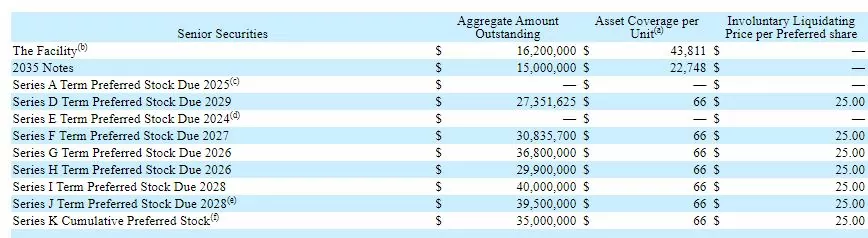

But on the other hand the CLO companies make it more difficult–some never mention their ratios at all–others mention it occasionally. For instance Priority Income Fund always publishes the coverage ratio with each prospectus they publish–and they publish plenty of those. Here is a snip from their most recent prospectus —

Our asset coverage on a pro forma basis after giving effect to the issuance of $39.5 million of shares of Series J Term Preferred Stock including overallotments, on August 10, 2021 and August 18, 2021, the redemption of approximately $36.7 million of shares of Series A Term Preferred Stock on August 11, 2021 as described under “Recent Events,” as well as the issuance of $35 million of shares of Series K Cumulative Preferred Stock in this offering and the assumed redemption of approximately $25.5 million of shares of Series E Term Preferred Stock, with respect to the Preferred Stock, is approximately 262%. The table below summarizes our pro forma asset coverage per unit.

Now when we get to the other CLO CEF’s we sometimes have to do a little more work. Here is an example of an easy one to calculate.

OFS Credit Company (OCCI) is a smaller holder of CLO’s. Data below is from their semi-annual report for the 6 months ending 4/30/2021.

The report shows approximately $126 million in total assets (investments and cash).

The company has issued term preferred stock issues–2 issues to be utilized as leverage. The 2 issues are here. The liquidation preference (some say par value) of these 2 issues are about $46 million. They have a couple million of other ‘payables’ outstanding–but NO debt.

So the coverage ratio is simply $123 million (I subtracted the $3 million in payables they owed) divided by $46 million – so 267% of coverage on 4/30/2021. This means that as investors we have plenty of assets to cover us–we have 1st claim on the assets since they have no debt.

Obviously some of the other CLO holders have financials that are a bit more complex than this small company–but in general calculating the coverage ratio calculations are similar.

vVery helpful information. I added to OCCIO term preferred yielding over 6% YTC. have You looked at XFLT-A coverage ? Thanks

Nikolas–last time I checked it was 300%

Nikolas–I also have that one–but I have most of them.

Tim, Thank you very much for posting this. such good content to learn from. been holding for around 4 years now Gabelli GGZ-A, GDV-G, GDV-H, GGT-E. Also, BCV-A and ECF-A. I knew about asset coverage existing but put my trust in the reputation of Gabelli so never bothered to look, which I know isn’t a good thing. Now I’m focused. Better late than never I suppose.

Tim, I owe you HUGE. I always thought that the children of parents of ill repute must be just as bad. Made lots of meaningful positions of baby bonds and preferreds from ECC and OXLC and OCCIO. Congrats on your name quoted by Wall Street journal. I will be very happy if you would consider taking some subscription fees from us. THANK YOU and THANKS to Gridbird too. I always take a look at your WEB site every very early morning BEFORE the market opens.

Tim, In the last few days, I was toying with PRIF-S when it was first trading with temporary symbol. I bought it fast at $25.53 and saw that it went down briefly below 25.4. Then I remember that you have sent sort of suggest that buy a little first since there is no commission for buyers. So, I bought some here and there. I notice that PRIF-S and ABRFP did not drop in price as PMT-C when trading in pink sheet. I realize that PMT common did not have very clean history in paying dividend EXACTLY on the day expected. So, I nibbled some from different accounts first selling some e.g. WFC-D (actually it became ok as the 10 year US T “behaved”). Judging from the history of PRIF preferreds and your note that it has good balance sheet, I am over loaded with PRIF-S. THANK YOU.

Thanks JohnKcal—it is always about all the folks here. I will add a donation button before the year is out.

Okay, Tim. All my best to you and your family. Please stay safe and healthy.

I was in your State, Minnesota, from September 1962 to June 1966, at St. John’s University, Collegeville, MN, not so far from St. Cloud. A very nice elderly couple, Mr. and Mrs. Matters from Duluth took me with them on their vacation to San Francisco, I immediately fell in love with that city. There were another couple in Duluth, Dr. and Mrs. Schneider, extremely kind people.

Good to hear John. Am very familiar with St Johns as one of our daughters attended St Ben’s and of our sons attended Gustavus Adolphus and played basketball so always had plenty of MIAC sports happening in Collegeville.