Another week and more ‘excitement’ will no doubt occur during the week. Weekends used to be kind of quiet, but now we have a continual stream of market moving events occurring 7 days a week. The past number of days we had Canada install a digital services tariff on U.S. companies and the U.S. administration pull out of Canadian tariff talks–then the Canadians removed the tariff. Almost all of this while markets were closed.

Last week the S&P500 moved to record levels and up 3.4% on the week. The index pulled back late in the day Friday to close at 6173–but futures are up nicely this morning and we are heading for new highs.

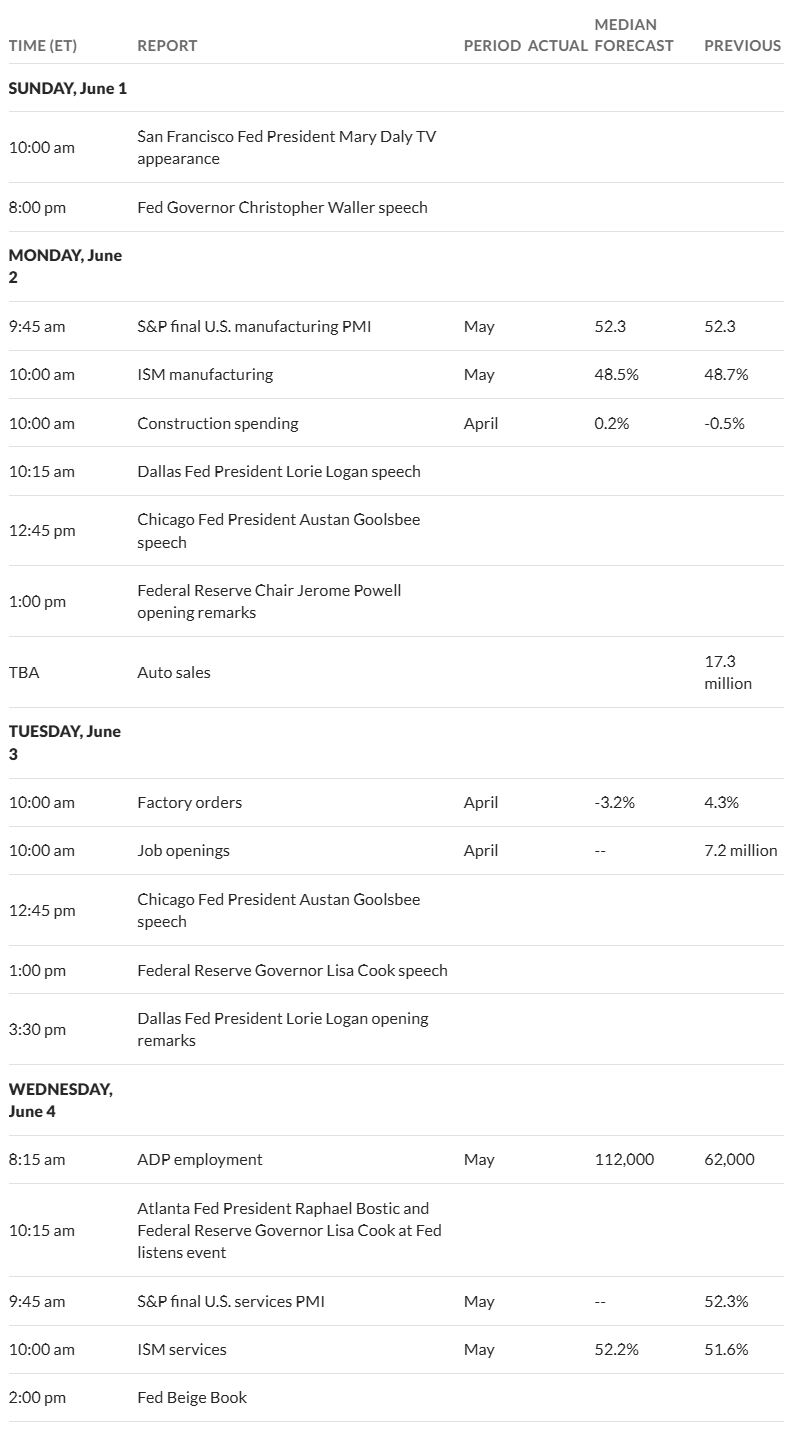

The economic news this week is accelerated because of the July 4th holiday on Friday–this means that we will have the June employment report on Thursday instead of the traditional 1st Friday of a month. This is a potential market moving event, although a negative market reaction will simply bring in the ‘buy the dip’ crowd so probably nothing to fear, unless you are short the market.

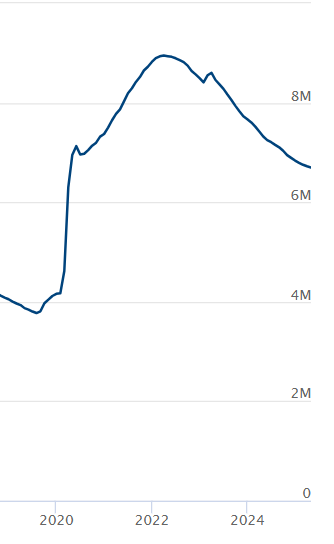

Finally the 10 year Treasury closed the week at the lower end of recent ranges–at 4.28%, although it was as low as 4.24% earlier on Friday. Certainly there is a sense the economy is slowing somewhat–while at the same time a belief that the economy will keep growing. Of course on the other hand we have plenty of government debt to sell which is likely to keep longer maturity interested rates elevated.

The Federal reserve balance sheet took a nice $19 billion dip in assets as the downward movement continues after a couple weeks of flattish moves.

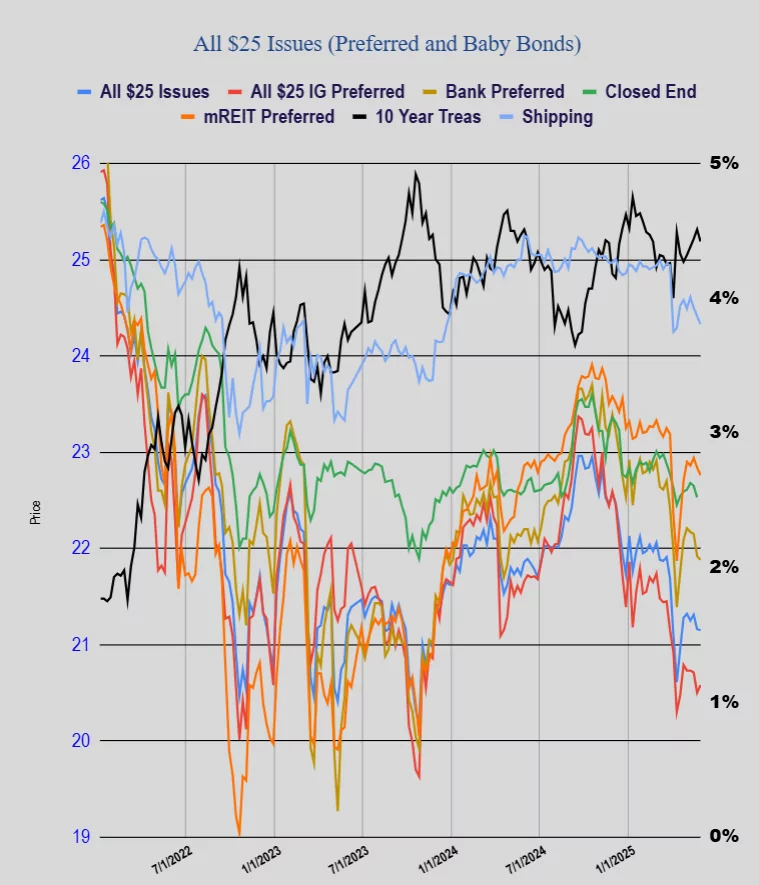

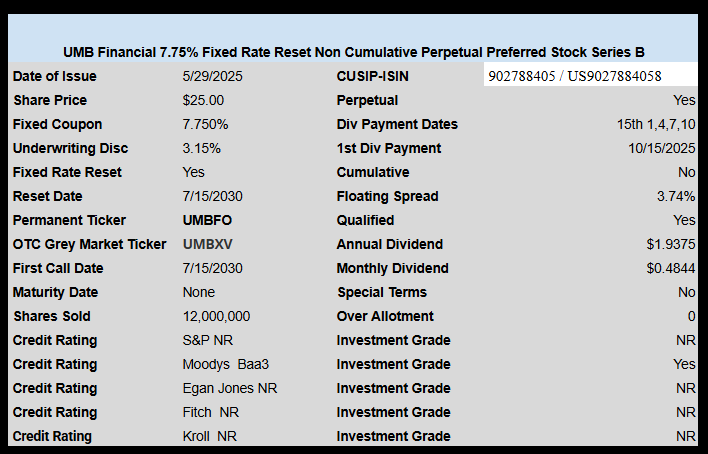

The average $25/share of preferred moved higher again last week–not strongly, just 8 cents–and up is up for the second week in a row. The average $25 shares moved 8 cents higher, investment grade issues moved 8 cents higher, bankers moved 6 higher, CEF preferreds 5 cents higher and mREIT issues 8 cents higher.