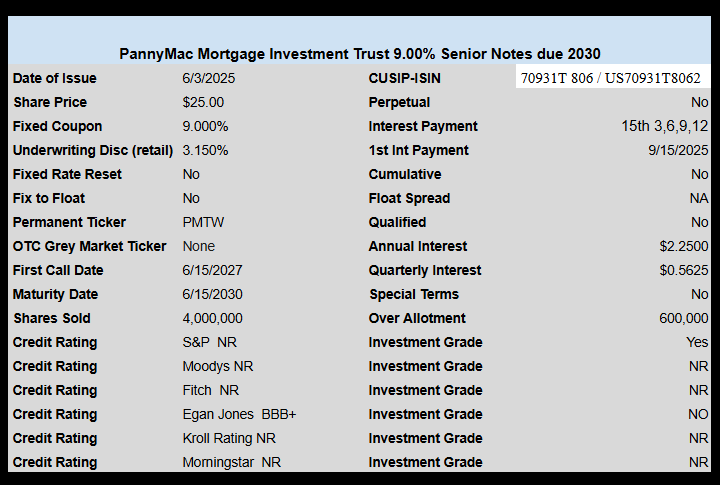

mREIT New York Mortgage Trust (NYMT) has announced they will be selling a new issue of Senior Notes with a maturity date in 2030.

This will be the 3rd issue that the company has outstanding–all sold in the last 13 months.

This is following a trend for mREITs to sell only baby bonds instead of preferred shares–

The preliminary prospectus can be read here.

Thanks to J for spotting this and for jerrymac who chimed in with ‘yield talk’ in the 9.875% area.