Sometimes we hesitate even posting items like these–most of the times they turn out to be meaningless.

On the other hand better to post than anyone get a surprise.

1st off I am not an expert on repurchase agreements that the Federal Reserve executes, but I am knowledgeable enough to know that the FED is now–and has been, executing repurchase agreements with the ‘primary’ dealers of government debt since September. The Fed takes government securities (including agency backed mortgages) as collateral and lends the institution money so they have enough liquidity to serve their customers.

The primary dealers are typically large banks and securities companies which are trading counterparties for the Federal Reserve. They are expected to ‘make markets’ in government securities. They generally must make bids for government debt at auctions. This is all done to implement monetary policy.

With that said the New York Fed releases a monthly forecast of open market REPO operations.

The Fed last released a monthly forecast on 12/12/2019 which can be seen here. This forecast covers the period ending 1/14/2020–thus we should see a new forecast soon–the end of this week or Monday.

Here’s the problem. When the REPO facility was started back in September it was in reaction to a huge spike in overnight lending rates–they spiked as high as 8-10% as liquidity was unavailable for those needing money. Supposedly the liquidity was needed for tax payments and for settlements of U.S. government securities–it was implied this was a relatively short term problem.

GUESS WHAT-the issue seems to go on and on and whether this liquidity crunch will improve is anyones guess.

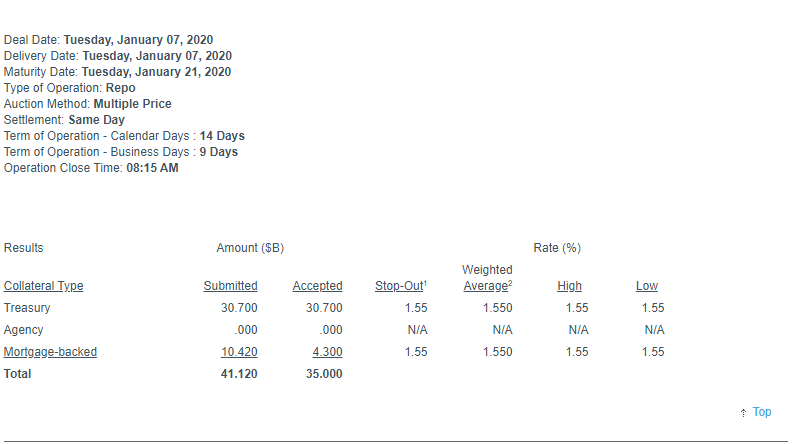

Today primary dealers offered $41 billion in collateral for a 14 day REPO, but the Fed only accepted $35 billion–this means less liquidity was supplied than the market thought it needed.

The question is – is the Fed going to try to withdraw liquidity? What will their next forecast show?

I will make my own forecast–the REPO will continue indefinitely. Additionally the size of the Fed Balance Sheet will continue to grow all throughout the year–there is no choice–the U.S. is going to run another $1 trillion dollar deficit.