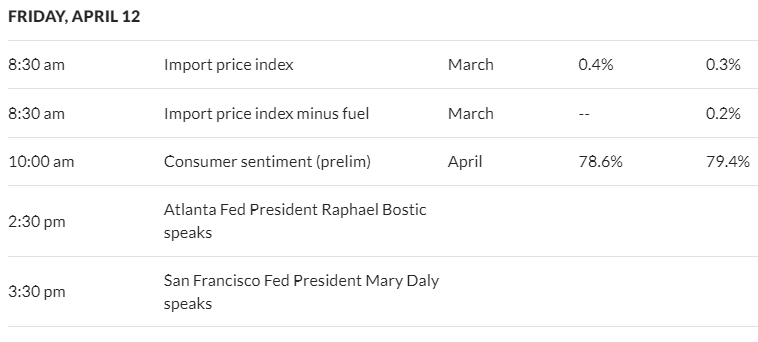

We have just 30 minutes until the release of important inflation data with the consumer price index (CPI). The reason this should be considered important is because the Fed ‘claims’ they need to see a number of good data points before they cut rates. Since we are looking at June at the earliest and more likely July or later before we see a rate cut we need to see good data points starting now.

Now do I want to see rate cuts? I have mixed feelings–I am really liking that folks that want my investment dollars are forced to pay me to use it. We went through a period of 10 years where we were lending money to banks etc and they didn’t even have to pay us (much). On the other hand the longer rates stay at elevated levels the deeper the hole the government is digging for itself as cheap treasuries mature and high coupon debt is sold to replace it–and we all know this will come home to roost at some point in time.

So the forecast for the headline inflation number is 3.4% (year over year) which would be up from 3.2% last month. The core rate is forecast at 3.7% versus 3.8%. Obviously we need numbers within a 1/10th or so on these to keep markets stable–if we are off by a number of 1/10th it is possible we see some fireworks in equities and/or interest rates.

My personal take on inflation is it is not slowing much (if any)–this is based on almost nothing. I do almost nothing when it comes to paying the household bills–I seldom ‘shop’–seldom buy groceries–my wife runs everything around this house. What do I do—work, work, work. But even though I do little shopping etc I do see some signs of continuing inflation–today what caught my eye was the cost of a 1st class stamp is likely going from 68 to 73 cents. Honestly I was shocked–I thought stamps were around 50 cents–talk about out of touch. I do buy fuel for my vehicle–and that is way up in the last number of months as west Texas intermediate trades up in the mid 80’s. I have completed a number of new construction house appraisals lately and I can guarantee prices remain sky high – you don’t get much for $500,000 anymore at least in Minnesota. Well we will see what happens shortly.

As noted I purchased a add on position to my Carlyle Credit Income Fund 8.75% term preferred (CCIA). No other purchases are contemplated this week–always subject to change of course.

The 10 year treasury is steady right now at 4.36%–obviously awaiting news. Equities are also little changed–we’ll see if this remains the case in a few hours.